Adulting 101: Bridging the Gap Between the Classroom and the Real World

February 23, 2023

More than ever, students feel like school isn’t preparing them for the real world. There’s no lesson on important life skills like filing taxes, opening a bank account, or applying for a job, and after graduation students find themselves scrambling to catch up. Many students are fortunate to have parents or guardians to ask for advice, but besides that, no one knows where to go. This does not have to be the case. Seton could very well have an elective to help cultivate life skills: Adulting 101. And this new course could be built upon the curriculum of its predecessor: Home Economics.

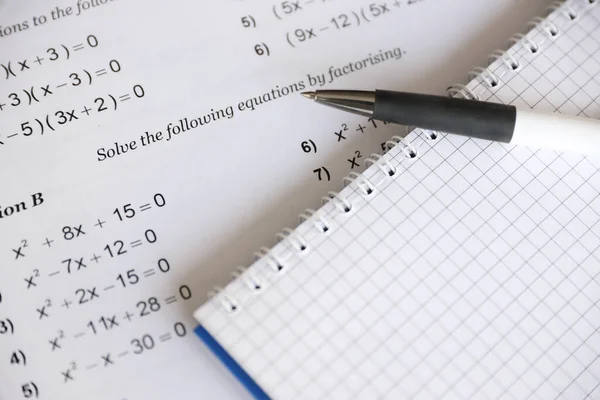

Home Economics, also known as Family and Consumer Sciences, was previously a required course in the late 20th century. It focused on teaching students home management, finances, nutrition, human development, cooking, sewing, and a wide variety of other practical skills. Its purpose was to help students develop life skills that would help them outside of the classroom or workplace. As time went on, colleges and universities started putting more weight on STEM subjects. School budgets decided to prioritize those courses instead, and Home Economics slowly but surely faded from the picture. Although STEM classes are incredibly important for education, students are missing out on skills that could put them ahead in life.

When asked about what she would like to learn if Seton had the class, junior Bernadetta Paolucci had a list of items. “Taxes, financial managing, planning doctors appointments and such, cooking…” Paul Ajak, a sophomore, had some similar overlap. “Everything you need,” he replied. “From how to buy a home, to a 401k.”

A well-rounded Home Economics curriculum could be split up into seven units (further detailed here):

- Cooking

- Child Development

- Education and Community Awareness

- Home Management and Design

- Sewing and Textiles

- Budgeting and Economics

- Health and Hygiene

Alternative coursework (proposed here) is split up into only five units:

- Human Development

- Food and Nutrition

- Financial Management

- Clothing and Textiles

- Shelter and Housing

Seton may run into difficulties implementing some of these lessons, such as cooking, because of budget and safety concerns. However, many of the other topics can be taught easily in a classroom setting.

Seton students might already be gaining some expertise in some of these skills in their other courses. Health teaches about child development and nutrition, as well as self management and prioritization. Economics students might know about budgeting and financial management, but this course would focus on the personal, practical application of these concepts – and answer all of the overlooked questions. There’s so much these courses don’t cover. What is the difference between different credit cards or types of insurance, and what does each cover? What is the difference between a Roth IRA and a traditional IRA? What’s the difference between an FHA loan and a traditional mortgage? How do you buy a house? A car? Negotiate a loan? The majority of students don’t actually know how much they’re missing, because they aren’t taught about any of this. Then suddenly they graduate and are expected to know it.

Students don’t need to be required to take this extra course, but they should be given the resources and opportunities to learn life skills. Home Economics, at its core, teaches responsibility and independence. Things like managing a checkbook, buying a house, and putting out a household fire, are all obstacles that students are likely to face at one point or another. Teaching foundational skills now helps students be the best prepared they can be. It gives them an advantage in the future for being well rounded and aware of how our world works. We at Voice of the Saints believe in a complete education, and think Adulting 101 is a step in the right direction.

![College of Community and Public Affairs graduates cheering during the CCPA Commencement Ceremony. [Via Daily Photos at binghamton.edu]](https://sccvoice.org/wp-content/uploads/2023/05/Screenshot-2023-05-16-10.50.55-PM.png)